5 Reasons Why You Should Never Finance Your RV

You’ve just found your dream RV. It has the layout, features, appliances, and fabric choices you have been dreaming of. You already have visions of setting it up at your favorite campsite in the mountains. However, you don’t have the cash set aside to buy it outright, but you have been just approved for an RV loan. You’re all set, right?

Hold your horses, because there are several reasons why you should never take out a loan for an RV.

RV loans, also known as recreational vehicle loans, refer to any financing used to purchase a motorhome, travel trailer, camper van, or truck camper. These types of non-real estate loans can also be used to purchase boats and other watercraft.

Much of the time, the loans are offered by banks and credit unions, finance companies, and even the finance department of RV dealerships. Not everyone can afford to buy a $100,000 Class A or fifth wheel, so it’s pretty amazing that you can quickly get the money to purchase your dream RV from one of these institutions.

According to financial experts, such as Dave Ramsey, you should never even finance a car much less an RV. In his various books, podcast, and YouTube channel he touts the benefits of paying cash for everything but a primary home. This includes a “dream” vehicle such as a camper or trailer. While saving up money for such a large purchase seems daunting, there are a few very good reasons to take this approach.

1. An RV is not an investment

No matter what we want to believe, an RV is never an “investment” in the traditional sense. Of course, it’s an investment in our own time, family time, and special experiences, but it does not go up or even retain its value over time. Unlike a traditional house, land, or even stocks and other liquid investments, an RV is a depreciating asset. In fact, a new RV can lose as much as 20 to 30 percent off its original price in the first year of ownership.

On the other hand, there are some vintage campers and trailers such as Airstream that will retain their value. If beautifully restored and regularly maintained, money can be made on a vintage RV. However, if you can help it, don’t finance a vintage RV either even if you think you can make money on it in the future.

2. It is more difficult to finance an RV

According to Credit Karma, it can be more difficult to get a loan for an RV than for a car. Most RV loan borrowers already have a loan for several other items such as a car. So lenders look at the current debt to income ratio to come up with an interest rate and a loan amount.

If your income is lower and you already have debt, your RV loan and its higher interest payments could be too much to handle. It’s best to not take on the extra debt and instead put money aside for a future RV purchase.

3. RV loans have higher interest rates (especially if you have a lower credit score)

While interest rates for RV loans hover around same percentage as a car loan, the rate goes up significantly if you have a lower credit score. This is usually under the recommended 660-700 score.

Interest rates available for lower scores are upwards of 20 percent. For a $15,000, 5-year loan, this equates to nearly $9,000 in interest costs. Even at only 4.5 percent, that $15,000 loan still has almost $2,000 in interest. That’s a lot of fuel.

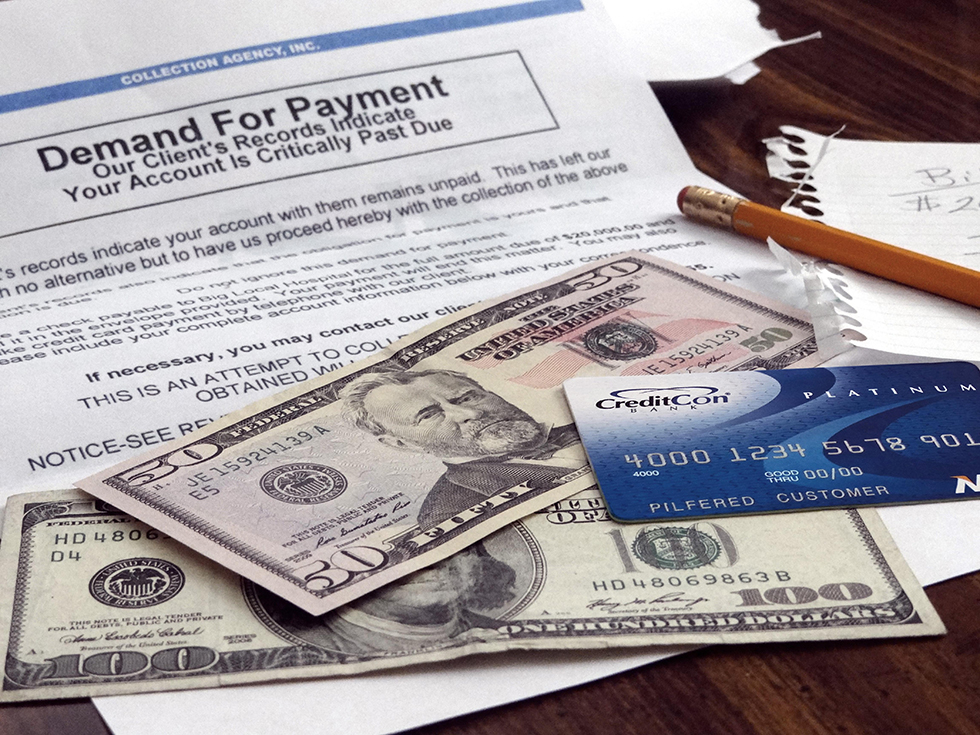

4. Repossession on RVs is high and ugly

If something happens and you are unable to make the payments on an RV loan, the vehicle or trailer can be repossessed by the bank or lender. Some people who fail to make payments on items such as furniture or TVs will try to hide the items from the repo guys. This is a little difficult for a large vehicle that is actually registered with the DMV.

Once the RV is repossessed the lender can rarely sell the RV for the original loan amount (see #1 on this list), so the loan then goes into collections. If you had to use collateral for the loan, such as your home, a lien can be put on your property or you can be taken to court for the remaining balance. Suddenly that dream RV has turned into a nightmare.

5. You never really own what you are financing

Financing a thing always means you never really own the thing. The bank or lender owns it. This can really put a dent in your RV vacation. How good would it feel to know that you fully own the camper or trailer you are taking on your favorite vacations?

In addition to not owning the RV, you are actually making payments on an item that you never really got to test out first. To avoid any issues that may crop up in your new RV, try before you buy with various rental RVs to figure out what you really want to save up for.